- You are here:

- Home »

- Author's Archive:

All posts by Ryan Olson

SW’s Signals of the Day – 3.20.17

The week started off with a whimper as the indexes moved little, closing mixed. The Dow and the S&P 500 both closed lower while the Nasdaq snagged a tiny .01% gain. The Nasdaq got the day off to an interesting start by setting a new all-time intraday high, but things calmed down very, very quickly in […]

Continue reading

Signals of the Day

Good afternoon folks and happy St. Patrick’s Day! The market closed out the week on a bit of a whimper as the major indexes saw little movement overall. They finished mixed with the S&P losing .09%, the Dow dropping .05% and the Nasdaq also declining .05%. That being said, the market is still extremely bullish overall […]

Continue reading

SignalWatch Daily Signal Picks – 3.15.17

What a day we had in the market. The Fed announced that it is looking to raise the interests rates twice throughout the course of 2017. The Fed has been hinting at rate hikes for a while now in an attempt not to send any shockwaves through the market. The announcement was met with a […]

Continue reading

Signals of the Day – 3.14.17

The market lost a bit of steam today, as all three of the major indexes closed with small losses. So far that has been a quiet week with most investors and traders hanging out of the market until the word about a possible interest rate hike comes out from the Fed’s meeting. The market mode […]

Continue reading

Signals of the Day – March 13, 2017

Today was a slow day throughout the markets as many traders stayed on the sideline waiting for the Fed meeting to begin tomorrow afternoon. The S&P and the Nasdaq closed with small gains while the Dow closed slightly down. The indexes are still in a very bullish mode so we are going to continue to use […]

Continue reading

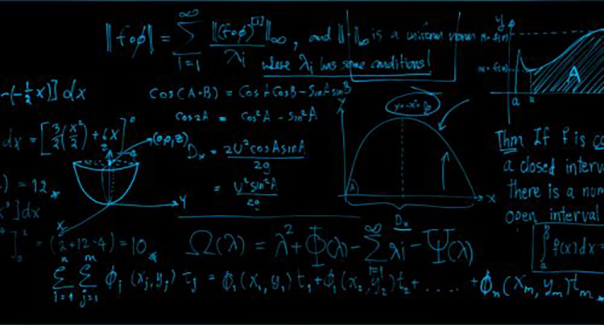

How Artificial Intelligence Revolutionized Trading

We are in an incredible time in trading history. Personal computers have become more powerful allowing advanced algorithms to process and analyze massive amounts of data. The inclusion of Artificial Intelligence (A.I.) into trading has exploded – allowing traders and trading companies to create systems and strategies that many only dreamed about just a […]

Continue reading

Personality of Markets Theory

Personality of Markets Theory. The Personality of Markets Theory basically states that individual securities exhibit individual personalities. If you can pinpoint a security’s personality, and apply the right trading system for that personality, you can more accurately predict its next move and make more money. The easiest way to see how the Personality of Markets […]

Continue reading

5 Tips to Swing Trade the Current Market

5 Pro Tips to Swing Trade the Current Market One great thing about swing trades is that they normally only last 1-3 days. This in itself helps limit the amount of risk you are exposed to with any given trade. Let’s take a look at a few conditional tips that will help improve YOUR odds […]

Continue reading

3 Reasons Expectancy Will Improve Your Trading

A Lesson in Expectancy. 3 reasons the Expectancy Will Improve Your Trading Right now, you may be pondering, “Just what exactly is Expectancy and why should I care about it? How will it help me?” Great questions both. Before we dive into detail on Expectancy, let’s look at the underlying theory behind it. Twenty-five years […]

Continue reading

Trading Signals of the Day – 3.9.17

The market hit the brakes on the slight pullback we’ve seen this week, with all three of the major indexes picking up small gains. The S&P 500 snagged .08%, the Dow tacked on .01%, and the Nasdaq netted a .02% gain. Crude oil and gold continued their slides, though, with the former losing 1.31% and […]

Continue reading