- You are here:

- Home »

- Today's Trades »

- SignalWatch – 4.18.17

SignalWatch – 4.18.17

April 18th

Evening folks. It was a gloomy day in the markets with all three indexes dropping sharply at the open and closing out the day with losses. But, there were no major news events, nor were the losses eye-popping, so like you hear in many police procedurals, nothing to see here folks, nothing to see. Let’s jump on into tonight’s signals.

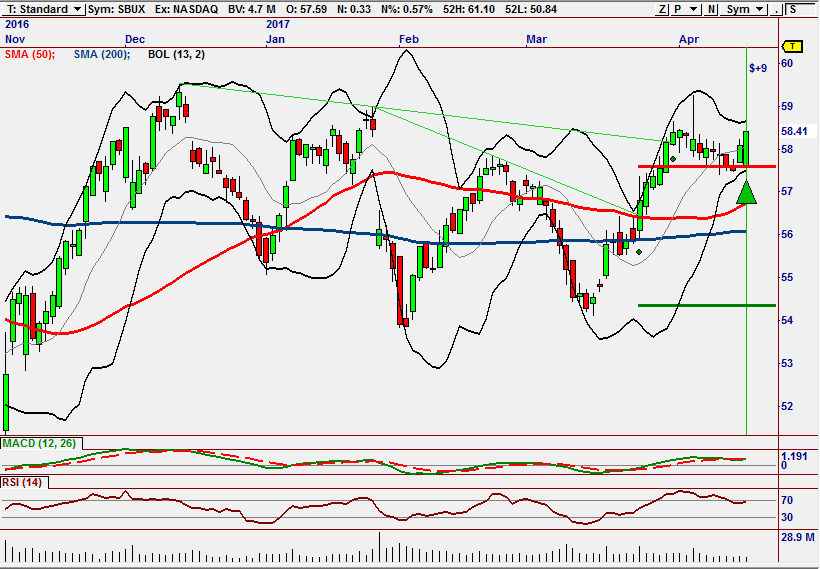

GroupTrader is looking for a new move on Starbucks.

For the first signal of the night, we have SBUX. It had a solid day today, picking up over .5% will pivoting off of support at $57.50. That pivot also confirms a new higher low for us. If it can push through resistance at $58.50, it may make a run at the $59-$60 zone heading into the summer.

This signal was fired off by the GT Momentum Strategy which is part of GroupTrader 3. GroupTrader looks for industry groups that are in a tight rotation and then singles out the most lucrative opportunities out of those groups. SBUX fits the bill and it does indeed look promising. For more info on how GroupTrader does its thing, check it out here.

Next on the docket, Micahel Kors.

Look out below, KORS may be heading lower.

KORS has just moved below its bullish trendline established back in February. After failing to move through the 50 SMA, KORS looks bound to test support at $36. Volume is light though, see if we see a big spike, a reversal move is possible.

This signal was kicked off by the CPS5 Trendline Break Strategy which is part of out CPRM6 Module. CPRM6 is all about chart patterns. Over two hundred of them in fact. It finds every single variation of ever single pattern in every single chart that you select. It even has the audacity to mark the charts for you. Outrageous. But seriously, its pretty cool. Chart patterns are one of the oldest tools in the technical analysis toolbox, but still one of the most reliable. So do yourself a favor and quit marking charts and let CPRM6 do the leg work.

Last up, CMA.

![]()

Check it, as the Beastie Boys would say, on CMA. It looks ready for a new bullish bounce and ACT2 agrees. It has bounced off of support close to $65 and volume is hopping. ACT has also found that it is beginning a new cycle of buying, which is ACT’s game. If things go according to plan and ACT called this one right, looks like the 50 SMA may see some action at $70.

That’s it for tonight folks. Have a good one and catch you all in the manana.

![]()

The products and demonstrations listed on this website are not recommendations to buy or sell, but rather guidelines to interpreting their respective analysis methods. This information should only be used by investors who are aware of the risks inherent in trading. Nirvana Systems shall have no liability for any investment decisions based on the use of their software, any trading strategies or any information provided through other services such as seminars, webinars, or content included in the SignalWatch website.

About the Author Ryan Belknap

Ryan has been with Nirvana since 2012 and has been manning the trading desk since Day 1. He was one of the founding members of Nirvana's Trading Lab and also TraderSource.com along with Ryan Olson and Russell Casperson. Ryan logged more than 3,500 hours trading and educating live in the Lab. He is also the lead author of SignalWatch.com. Ryan is a seasoned educator and has conducted numerous educational webinars and is an OmniTrader University instructor. Ryan prefers swing trading and position trading. Outside of the market, Ryan has passions for the outdoors, baseball, exercise, coffee, pop-culture and spending time with his family.