- You are here:

- Home »

- Today's Trades »

- SignalWatch – 4.11.17

SignalWatch – 4.11.17

April 11th

Good evening folks! Man, what a day. The indexes all opened to the downside but tried their darndest to return to the green. They came close to pulling the comeback, but the major indexes all closed slightly in the red. Worries over geopolitical situations continue to weigh on many investors minds and many are heading for the sidelines or safer investments like gold, which closed up 1.80%! Things are about to get even more interesting with earnings season about to get underway. So stay on your toes, be flexible and keep your head on a swivel as we used to say on the football field.

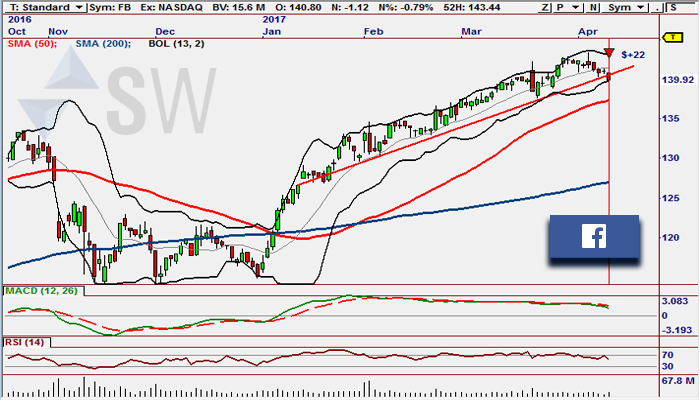

As for the signals, we have three brand new, ready to go signals on deck. First up, Facebook.

CPRM6 is looking for a quick move to the downside after the bullish trendline was broken.

Facebook has obviously been in a super-strong trend for quite awhile. It has been setting constant higher highs and higher lows along the way and has been pretty much a trend trader’s dream stock. But with its recent move through the bullish trend to the downside, things could get interesting, at least in the short-term. FB is coming off of the overbought zone on the RSI and is testing support at $140. If support is violated, we could see a move down to the 50 SMA at $137.50 before it reports earnings early next month.

This signal was fired by the CPS5 Trendline Breakout Strategy that is part of our Chart Pattern Recognition Module 6 (CPRM6). CPRM6 uses over 200 systems to scan the entire market to find the strongest patterns that have formed. In fact, when I am prospecting, I only allow patterns that have the strongest ranking to fire signals. This results in fewer patterns, but much higher accuracy. Trading chart patterns is a fundamental part of technical analysis and many traders have their favorites. Ed prefers Saucers, Olson prefers Triangles while I love moves off of trendlines. So this signal is right up my alley. If you’d like to know more about CPRM6, check out its literature here.

Next on the agenda, Amgen.

A reversion move could be in the works on AMGN.

AMGN has been puttering along in consolidation for the better part of a month just above the 200 moving average. Just prior to the consolidation period it is now in, AMGN underwent a significant pullback after being in a very healthy uptrend starting back in November. What this strategy is looking for, which is part of our TradeScope Pro plug-in, is extended pullbacks in healthy trends that could result in large reversion moves. TradeScope Pro uses our Strategy Block that acts as a Signal Filter based on probability. If TS finds a signal that meets the right criteria of being a high percentage trade based on historical moves, a signal is fired and a profit target is also given. Pretty cool. In this case, TS is looking for AMGN to run on into the $175 zone before hitting the breaks. To find out more on TradeScope, check out the PDF.

Last up, a little deja vu with Chevron.

Another short signal on CVX.

Last night CVX was featured right here on SW, and while its signal from last night did yield a .46% gain if you went short, a new iTLB3 signal is too good to pass up. The same conditions apply to tonight as they did last night, overbought, lower high, bearish trend, yadda yadda yadda. What makes this signal interesting is what the strategy is looking for. iTLB’s goal is to just identify a trending market, but also to determine the quality of the trend. To do this, it identifies major tops and bottoms in the recent market. Then it looks at all of the price action from the major lowest low pivot and calculates the intrinsic trend. This is different from classic trend analysis in that trend lines are not used to establish a trend. If iTLB calls this move correctly, it looks like this and last night’s Darvas signal have CVX heading into $107-$106 territory before it reports earnings on 4.28.

That’s it for tonight. Have a wonderful evening and we will see you manana!

![]()

The products and demonstrations listed on this website are not recommendations to buy or sell, but rather guidelines to interpreting their respective analysis methods. This information should only be used by investors who are aware of the risks inherent in trading. Nirvana Systems shall have no liability for any investment decisions based on the use of their software, any trading strategies or any information provided through other services such as seminars, webinars, or content included in the SignalWatch website.

About the Author Ryan Belknap

Ryan has been with Nirvana since 2012 and has been manning the trading desk since Day 1. He was one of the founding members of Nirvana's Trading Lab and also TraderSource.com along with Ryan Olson and Russell Casperson. Ryan logged more than 3,500 hours trading and educating live in the Lab. He is also the lead author of SignalWatch.com. Ryan is a seasoned educator and has conducted numerous educational webinars and is an OmniTrader University instructor. Ryan prefers swing trading and position trading. Outside of the market, Ryan has passions for the outdoors, baseball, exercise, coffee, pop-culture and spending time with his family.