- You are here:

- Home »

- Today's Trades »

- Signals of the Day – This One is for the Bears

Signals of the Day – This One is for the Bears

Hello all! This afternoon a flurry of short signals were fired so, I decided to go ahead and feature an all bearish list today. Now, I will be upfront and tell you that while these signals are good, I don’t personally short trades that I intend to trade overnight. I also am not actively trading these stocks. These are also likely to be short term moves. So keep that in mind when looking at these new sell signals. Without further ado, on to the signals!

The Darvas Box is looking for a bearish slide on AAPL down into the $140 zone.

AAPL has pulled back after making new highs earlier this month. After its sudden drop, it began to trade in a tight consolidation right along support near $143. It is now gaining some momentum as it is heading back down to test that support level once more. If that support level is violated, we could see AAPL head down even further to its next major level of support, down at $140. At that point, I would imagine the bulls to run back in and end the bearish move.

This signal is provided by the Darvas Box plug-in. The strategy is based on Nicolas Darvas’ work, which has been used successfully for decades by vast amounts of traders. What the Darvas Box is looking for are increases and decreases in momentum. The Darvas strategies use market momentum to enter and exit trades. If a stock’s price breaks out of a Darvas Box or reverses off of a Darvas resistance level it is a considered a solid short candidate. As we see, AAPL is about to break out of a Darvas Bow to the downside. You can find the Darvas Box Suite here.

Did You Know?

All of the great signals you see featured on SignalWatch all come from out very own strategies. A question we always get is, “Can I use these strategies on other paltforms?” The answer is no. But, we want you all to be able to use our great strategies so we’ve got an easy fix! Just for being a SignalWatch member, we’ll hook you up with your very own OmniTrader 2017 trial, on the house for 30 days! You can trade with it, prospect with it. Anything you like. So give it a whirl. We know you’ll love it.

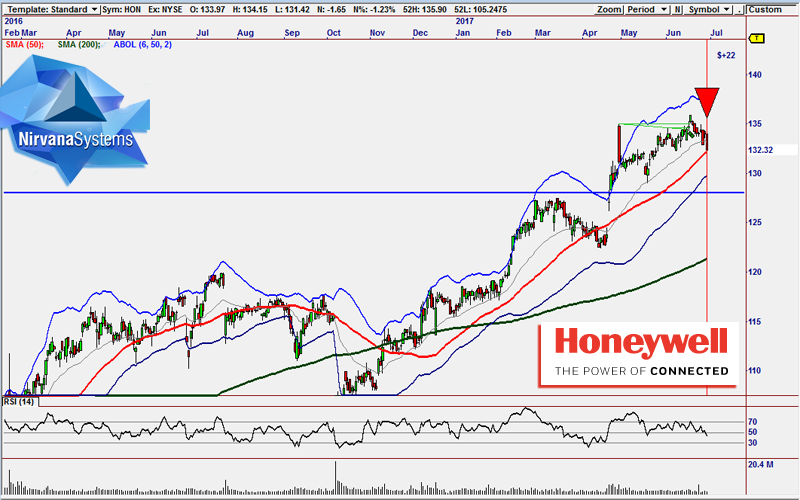

Next up, Honeywell.

The GMMA is looking for a resistance reversal on HON.

HON has been super-strong as of late, but it has run into a roadblock at resistance at $135. It has pulled back quite suddenly and is now testing the 50 SMA. This is a significant test, seeing as the 50 period SMA is used to gauge the trend sentiment of a stock. If a stock is trading above the 50, it’s considered in a bullish mode and if the opposite is true, it’s considered to be in a bearish mode. If HON manages to fall through the 50 SMA, look for it to drop down and test support at $130. At that time, it will be important to reevaluate the move because that could set up a bullish reversal.

The GMMA as a whole is a composite view of 12 different Moving Averages which gives traders a powerful view of different trends. The expansion and contraction of those 12 averages provide direction as to what stage a trend is in as well as the stability. The Guppy Multiple Moving Average indicator is to tell the difference between traders and investor action. When the two groups of averages are consistently separated it shows trend consistency because traders are not prepared to let prices decline too far before they start to buy once again. The Guppy Power Strategy uses several tools from our new GMMA 2.0 Plug-in. This Mechanical Strategy uses the CBL to identify entries and maximum risk. It also uses the TVL trailing stop to maximize winning trades. It’s solid strategy suite and worth checking out its literature here.

The last signal for the day is on VZ.

CPRM6 is looking for VZ to continue to head lower inside of the bearish channel it has been trading in.

Unlike AAPL and HON, VZ has been sliding for the entire year. And it has been doing so in a rather orderly manner, trading within a nice range and setting up nice lower high setups along the way. It has recently pivoted off of the upper boundary of the range and is now picking up some bearish momentum and we can see that volume is on the rise. CPS5 is looking for VZ to continue to move lower and test the bottom of the range once again, this time in the $44-$43 zone.

Our Chart Pattern Recognition Module has long been on of our most popular plug-ins for OmniTrader. CPRM6 identifies over 200 patterns, strength ratings, a pattern tutor. CPRM6 provides the flexibility of getting pattern confirmation in either higher timeframes or lower timeframes – or BOTH! Whether you enable a higher timeframe or a lower timeframe, CPRM6 will analyze all the enabled timeframes in your Profile and show you any recent patterns. The CPRM6 EOD Profile looks at the Daily chart and the Weekly chart in order determine which trades have the highest profit potential. Finding patterns in the same direction gives us an incredibly highly confirmed trade. To learn more, check it out here.

That’s all for today! We’ll catch you guys back here tomorrow!

The products and demonstrations listed on this website are not recommendations to buy or sell, but rather guidelines to interpreting their respective analysis methods. This information should only be used by investors who are aware of the risks inherent in trading. Nirvana Systems shall have no liability for any investment decisions based on the use of their software, any trading strategies or any information provided through other services such as seminars, webinars, or content included in the SignalWatch website.

About the Author Ryan Belknap

Ryan has been with Nirvana since 2012 and has been manning the trading desk since Day 1. He was one of the founding members of Nirvana's Trading Lab and also TraderSource.com along with Ryan Olson and Russell Casperson. Ryan logged more than 3,500 hours trading and educating live in the Lab. He is also the lead author of SignalWatch.com. Ryan is a seasoned educator and has conducted numerous educational webinars and is an OmniTrader University instructor. Ryan prefers swing trading and position trading. Outside of the market, Ryan has passions for the outdoors, baseball, exercise, coffee, pop-culture and spending time with his family.