- You are here:

- Home »

- Today's Trades »

- Signals of the Day – July 24th

Signals of the Day – July 24th

Welcome Back!

Welcome back! We took a little hiatus on the signals as we readied the new features and they are rolling out soon. As you guys know, creating a solid, great looking, smoothing working site takes a ton of work and testing, and frankly a lot of time as well. Because we are a small team, we all carry heavy work loads and had to focus else where over the past several days. But have no fear! The SignalWatch team is here.

So how’s the market been behaving since we last saw it? Well earnings season is in full swing and the indexes closed mixed today in wake of some reports. The Dow 30 closed in the red for a loss of .31%, the S&P finished down .11% and the Nasdaq went the opposite direction and closed up .36% for the day. Crude and Gold also saw gains on the day. As for our Signals of the Day, we are going to be looking at three new buy signals on CMI, DIS and SBUX.

WaveTrader is looking for new highs on CMI.

What a fantastic trend we have here. CMI has been rocking and rolling for months and is now poised to possibly breakout and score new highs. It pivoted higher off of the monthly VWAP indicator and picked up steam from an volume surge. It is currently testing resistance right that the $166.50 value, and if that level is exceeded, would could very well see a run into the $170 zone before undergoing another pullback.

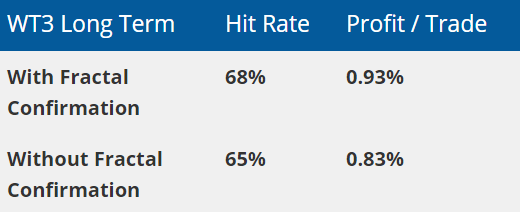

This signal was produced by the WaveTrader 3 plug-in and more specifically, the WT3 Long Term strategy. The WT3 Long Term Strategy employs a trade plan which uses a trailing stop to help max out your gains while also applying a break even stop to help lock in a small profits if the trade doesn’t turn out. Once can expect a WT3 Long Term trade to last 1-3 months on average. The most important thing to note is that by using multiple sizes of waves increases both the strategy’s accuracy and profitability! To learn more about WT3, check out its page here!

By using multiple waves lengths, we see increased accuracy and profitability.

Did You Know?

Try OT Now

Next up, Disney.

The Darvas Box plug-in is looking for a breakout move on DIS.

DIS made some splashes over the course of a month, announcing Star Wars Land at its amusement parks, which was met with great aplomb and they crushed it at Comic-Con, generated a ton of buzz for Marvel Studios Phase 3 films. So, as it is riding a massive pop-culture swell of good vibes, its stock is trying to cash in and score a breakout move. It is testing resistance close to $108, which is also the top of its current Darvas Box. Volume is increasing and if we see a pop, it could trigger a buying frenzy.

This signal is a Darvas Classic Strategy signal which is part of our popular Darvas Box Suite. These strategies are based off of Nicolas Darvas’ work, the Darvas Box Theory. The Darvas Box finds increases and decreases in momentum essentially. The Darvas strategies utilize market momentum to place and close trades. If a stock’s price breaks through a Darvas Box resistance lever or reverses off of a Darvas support level, a new buy signal is generated. And as we can see, DIS is about to break out of a Darvas Box to the upside. You can find the Darvas Box Suite here.

Last but not least, SBUX.

TS Swing has found a new swing trading candidate in SBUX.

Starbucks has been in a decline since the later half of Q2, but it hit the brakes on its decline at the 200 SMA and looks like it could attempt a short-term swing trade since it will report earnings later this week. It is very oversold and pivoting off of an existing trend ling. Volume is also on the rise. If this move does materialize, we could be looking at a pop into the $59-$60 zone before its earnings report.

This signal comes to us via the TradeScope Pro plug-in. TradeScope determines the probability of chart movement when indicators are combined. It comes with several pre-built TradeScopes so you can immediately benefit from the technology. For TradeScope Pro, we added two great features, the TradeScope Toolbar and Historical View, making it easy to switch between TradeScopes. Many of our customer also use TradeScope Pro for research. Plug in the indicators you use and TradeScope will tell you how predictive they actually are, and which combinations lead to the most success. To learn more, check out its PDF.

That’s all for tonight. Catch you back here in the manana!

![]()

The products and demonstrations listed on this website are not recommendations to buy or sell, but rather guidelines to interpreting their respective analysis methods. This information should only be used by investors who are aware of the risks inherent in trading. Nirvana Systems shall have no liability for any investment decisions based on the use of their software, any trading strategies or any information provided through other services such as seminars, webinars, or content included in the SignalWatch website.

About the Author Ryan Belknap

Ryan has been with Nirvana since 2012 and has been manning the trading desk since Day 1. He was one of the founding members of Nirvana's Trading Lab and also TraderSource.com along with Ryan Olson and Russell Casperson. Ryan logged more than 3,500 hours trading and educating live in the Lab. He is also the lead author of SignalWatch.com. Ryan is a seasoned educator and has conducted numerous educational webinars and is an OmniTrader University instructor. Ryan prefers swing trading and position trading. Outside of the market, Ryan has passions for the outdoors, baseball, exercise, coffee, pop-culture and spending time with his family.