- You are here:

- Home »

- Today's Trades »

- Signals of the Day – 6.26.17 – APD, ADM & BRK.B

Signals of the Day – 6.26.17 – APD, ADM & BRK.B

Signals of the Day

Welcome one, welcome all! The indexes were rather anemic today, with the S&P 500 and Dow 30 securing small gains while the Nasdaq dropped -0.29%. Crude oil was able to bounce back a bit from last weeks moves, closing up over 1% for the day. We have three new buy signals to look over tonight. The featured signals are on ADM, BRK.B and ADP.

Try OmniTrader Now

Advanced Cycle Trader is calling for the next bullish cycle on ADM.

ADM is currently testing support close to $41, which also happens to be the bottom of a trading range it has been moving in since early May. It is oversold on both the classic RSI and Adaptive RSI (an ACT 2.0 specialized indicator) and Adaptive Bollinger Bands. All of these indicators are essentially telling us the same thing, th is guy is way too oversold and is likely to get a bump off of support. The last two times this level was tested, back in early May and early June, we saw nice pops both times. If ADM does pick up some steam, it may run back into the $42.50 area, where the 50 SMA is laying in wait.

is guy is way too oversold and is likely to get a bump off of support. The last two times this level was tested, back in early May and early June, we saw nice pops both times. If ADM does pick up some steam, it may run back into the $42.50 area, where the 50 SMA is laying in wait.

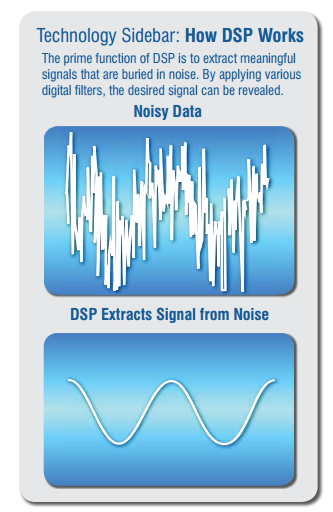

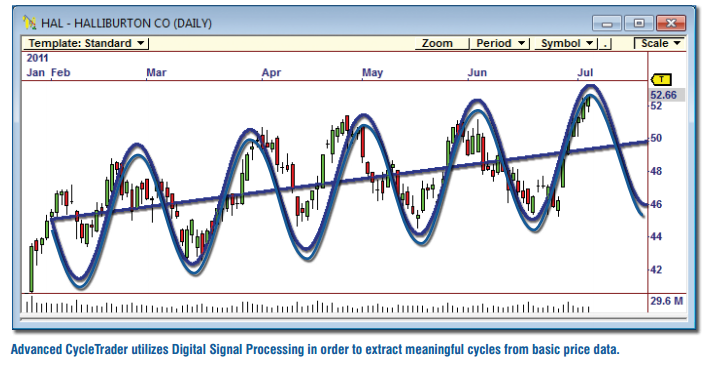

The strategy that generated this signal is the ACT EOD. This strategy makes up part of the Advanced Cycle Trader 2.0 plug-in. ACT 2.0 is all about finding market cycles, If one can identify a cycle and its low, one could profit by buying at cycle lows and selling at highs. Pretty straight forward. ACT 2.0 is so good at finding these new cycles because it uses Digital Signal Processing (DSP) techniques to accurately identify cycle lows. DSP allows ACT 2.0 has more responsive indicators and systems that are more accurate and less prone to whipsaw moves. ACT even filters which cycles are the strongest and how stable they are. To learn more about ACT 2.0, you can check out its literature here!

Next up, ADP.

WaveTrader is looking for a pop on ADP.

Recent moves captured by WaveTrader.

ADP has been enjoying a nice resurgence over the past two months after getting clobbered by a poor earnings report earlier this summer. It has recently pulled back to the 50 SMA, which is also acting as support, which it has responded to buy pivoting back in favors of the bulls. It is also close to being oversold, putting it in solid buying territory as far as the RSI is concerned. The MACD indicator is also in bullish territory and the WT indicators (featured on the chart) are looking for the next bullish wave. If that does indeed follow through, we could be looking at a move back into the $104 zone.

The WT3 Long Term strategy is part of the WaveTrader 3.0 plug-in. WT3 is designed for swing traders, seeing as it only seeks out stocks that currently have Higher Lows & Lower Highs. Why just those? Because in Swing Trading, one buys on pull-backs at a Higher Lows and in correcting markets, one would short the first Lower High. WaveTrader is designed specifically to find these Higher Low and Lower High pivots before they finish forming. If you’d like dive deeper (sorry for the pun) on WaveTrader, feel free to do so here.

The last signal of the evening is T3 signal on Berkshire Hathaway.

The T3 Power Suite likes what it sees on Berkshire Hathaway.

After pivoting off of support last month, BRK.B has enjoyed a solid run from $161 all the way to $172 before undergoing its current pull back. It is closing in on the 50 SMA though, which will provide some support, making it a natural spot to see a new higher low pivot. If that move does indeed happen, we could see BRK.B back on its way to the $172 zone.

The T3 Strategies look for temporary pullbacks in the market, placing Long Trades on the probability of a reaction rally. This concept as we all know is called Reversion to Mean trading. Markets trend about 80% of the time and within these trends are pullbacks that create temporary oversold conditions. The idea is to find these pullbacks precisely when they appear oversold to the market and then buy them just ahead of the bounce. The T3 strategies are also tailor made for those who don’t want to be exposed for long periods of time. All of the T3 strategies are designed to capture quick upside moves and exit, so you’re not at risk in the market for long periods of time. And because the T3 strategies don’t stay in play long, they achieve higher means they produce much more consistent gains.

Remember, all of these strategies are available over at NirvanaSystems.com and they only only work on Nirvana software. If you don’t have OmniTrader yet and your’e a little wary of committing a lot of time and money into a new platform, we kept you in mind. Not only is OT easy to use, you can try it for FREE. Run these strategies for yourself and you’ll never go back to those other, less robust, less accurate platforms.

Have a wonderful evening and we’ll see you back here tomorrow!

The products and demonstrations listed on this website are not recommendations to buy or sell, but rather guidelines to interpreting their respective analysis methods. This information should only be used by investors who are aware of the risks inherent in trading. Nirvana Systems shall have no liability for any investment decisions based on the use of their software, any trading strategies or any information provided through other services such as seminars, webinars, or content included in the SignalWatch website.

About the Author Ryan Belknap

Ryan has been with Nirvana since 2012 and has been manning the trading desk since Day 1. He was one of the founding members of Nirvana's Trading Lab and also TraderSource.com along with Ryan Olson and Russell Casperson. Ryan logged more than 3,500 hours trading and educating live in the Lab. He is also the lead author of SignalWatch.com. Ryan is a seasoned educator and has conducted numerous educational webinars and is an OmniTrader University instructor. Ryan prefers swing trading and position trading. Outside of the market, Ryan has passions for the outdoors, baseball, exercise, coffee, pop-culture and spending time with his family.