- You are here:

- Home »

- Today's Trades »

- Signals of the Day – 6.14.17

Signals of the Day – 6.14.17

June 14th

The indexes closed mixed today after the Fed announced an interest rate hike of a quarter of a point. This is the first rate hike in months and it signals that the central bank has a brighter outlook on the economy as a whole. Fed Chair Janet Yellen also upgraded the forecast for growth and unemployment. While rates are rising now, they are still very low historically so if you’re in the market for big-ticket items, now is a good time to buy. As for the signals, lets get to them!

OmniTrader is looking for a nice reversal move on Carmax.

KMX enjoyed a strong bullish run in the spring, but pulled back to start the summer. In the past few days though, it has been moving steadily higher after pivoting off of a confluence level that is comprised of several indicators, those being the 50 SMA, the 200 SMA, support and the lower high pivot point. It is also oversold on the RSI and Bollinger Band indicators, which puts it in prime RTM entry territory. For this particular move, we are looking for a price target in the $64-$66 zone.

This signal is brought to you by OmniTrader 2017. OmniTrader is our flagship platform and it has been helping traders rock the market for over 20 years! OmniTrader uses hundreds of trading indicators and systems and also enables you to trade directly from the charts. OT also includes built in strategies, including the Trending Reversal strategy. OmniTrader uses our Adaptive Reasoning Model (ARM) technology to generate buy and sell signals based on the market mode of each security in any symbol list. Pretty solid for just a base platform.

Many of you are seasoned OT veterans, but there are still some folks out there that are mulling the idea about jumping into OT. Our strategies only run on Nirvana software, so you need to use OT or VisualTrader to find more signals yourself. But, we’ve got you covered! Because your’e a SW family member, we’re offering a special 30-day risk free trial. No strings. No limitations. So jump in the fire and check it out!

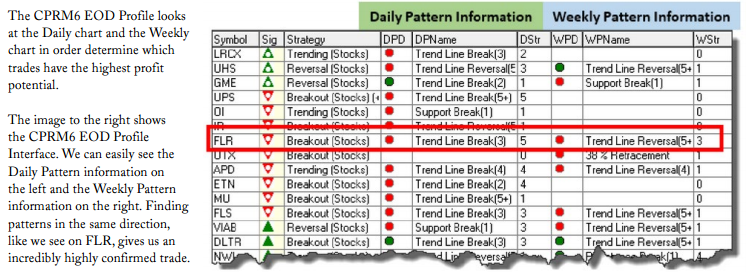

Our next signal comes to us via the Chart Pattern Recognition Module 6, or CPRM6 trading module and more specifically the CPS5 Cup and Handle strategy.

A new Cup and Handle pattern has formed on DPS.

DPS is sporting one of my favorite patterns, the Cup and Handle. The Cup with Handle pattern is a bullish continuation pattern that marks a period of consolidation followed by a breakout. There are two pieces to this chart pattern, the cup and the handle. Buried the lead didn’t we? The cup forms when prices rise in a gradual manner which looks like a bowl when charted. When the cup is fully formed, a trading range emerges on the right side of the char and the handle is identified. A price continuation is signaled when a symbol breaks out from the handle’s range.

We see a fantastic example of this pattern above on DPS. The cup formed from late April to late May and the rangewas just broken today. It is also a nice coincidence that the range also coincides with the 50 SMA. Volume is also on the rise which gives us more confirmation that a price increase is likely. If this pattern plays out, look for a push into the $95-$96 zone.

As mentioned above, this signal was fired by CPRM6 . CPRM6 automatically finds stocks with the strongest patterns in the market. CPRM6, also findS the best patterns in ALL time-frames. It also compares patterns to higher time-frames to insure maximum accuracy. To learn more about CPRM6, check it out here!

For our last signal, let’s take a look at FITB.

A new ACT signal is open on FITB.

FITB had a nice day today and wrapped up with a gain of over 1% on the day. It is now testing resistance just shy of $26, but if it can push through that level,we will have a full on resistance breakout on our hands. Resistance forms when an excess amount of supply for any stock accumulates at a particular price which results in an oversupply that squashes the stock’s demand which halts the increase in value. Simple right? When the supply glut evens out, resistance is usually broken with a large upward move that is a result of the big shift in supply and demand. So, if we see this breakout come to fruition, we could be looking at a move up into the $27-$28 zone in the near future.

This signal was fired by the ACT 2.0 strategy suite. ACT 2.0 uses Digital Signal Processing, or DSP to process market data and to find new trading cycles. ACT uses the Market Mode Indicator (MMI), which identifies the personality, or mode, of the market and the MMI indicator, which determines when a market is cycling or trending. When we know the market mode, we can look for good cycle trades following along with the mode. ACT shows you both short and long term cycles. The Spectrum Indicator shows you the strength and stability of the strongest market cycle, and ACT’s Heatmap shows a overall view of the market cycles that are currently in play. ACT also uses an OptiSmooth Filter which reduces the lag that is inherent in most other smoothing indicators.

That’s all for tonight folks. Have a wonderful evening!

The products and demonstrations listed on this website are not recommendations to buy or sell, but rather guidelines to interpreting their respective analysis methods. This information should only be used by investors who are aware of the risks inherent in trading. Nirvana Systems shall have no liability for any investment decisions based on the use of their software, any trading strategies or any information provided through other services such as seminars, webinars, or content included in the SignalWatch website.

About the Author Ryan Belknap

Ryan has been with Nirvana since 2012 and has been manning the trading desk since Day 1. He was one of the founding members of Nirvana's Trading Lab and also TraderSource.com along with Ryan Olson and Russell Casperson. Ryan logged more than 3,500 hours trading and educating live in the Lab. He is also the lead author of SignalWatch.com. Ryan is a seasoned educator and has conducted numerous educational webinars and is an OmniTrader University instructor. Ryan prefers swing trading and position trading. Outside of the market, Ryan has passions for the outdoors, baseball, exercise, coffee, pop-culture and spending time with his family.