- You are here:

- Home »

- Today's Trades »

- Signals of the Day – 6.21.17

Signals of the Day – 6.21.17

Welcome

The market saw some uncertainty today as traders tried to get a grip after oil took a hit (-2.25%). The tech and health care sectors provided some buoyancy though, as both rallied throughout the day. The indexes closed mixed, the S&P – 0.06%, the Dow -0.27% and the Nasdaq bucked the trend to close +0.74%.

Tonight’s signals are all buy signals fired by three of our hottest strategies. So let’s get going!

We are looking at a new GMMA signal on NFLX.

Netflix needs no introduction, seeing as it is one of the most highly traded stocks in the entire market. The tech giant has been crushing it since last year, trending higher in a nice and steady manner. The steadier the trend the more reliable is and we are currently seeing a brand new higher low forming along support at $150. As Cousin Eddy would say, “it’s really nice.” NFLX is also oversold, which is exactly where we want to start looking for potential entries. Volume is also starting to get a little stronger, and if we see that pop, it isn’t out of the question to see this guy run back into the $160’s quickly.

This signal was generated by the GMMA 2.0 plug-in, and the Guppy GMMA Reversal strategy specificall y. We actually have been seeing quite a few of these signals lately. In fact, we featured on last night on Salesforce, which netted close to +1% during today’s session.

y. We actually have been seeing quite a few of these signals lately. In fact, we featured on last night on Salesforce, which netted close to +1% during today’s session.

The GMMA Reversal Strategy fires Long signals only and it uses the original GMMA (GAMS and GA Separation), along with Guppy’s Trend Volatility Line (TVL) Trailing Stop. The GMMA looks to enter trades during pull-backs in a bullish trend. The GAMS system produces the signals on the pull-backs, while the GA Separation indicator is used as a filter to confirm the trend. Guppy’s TVL stop helps to maximize gains.

The GMMA as a whole is a composite view of 12 different Moving Averages which gives traders a powerful view of different trends. The expansion and contraction of those 12 averages provide direction as to what stage a trend is in as well as the stability. The Guppy Multiple Moving Average indicator is to tell the difference between traders and investor action. When the two groups of averages are consistently separated it shows trend consistency because traders are not prepared to let prices decline too far before they start to buy once again. It’s solid strategy suite and worth checking out its literature here.

Next on the docket, ALK.

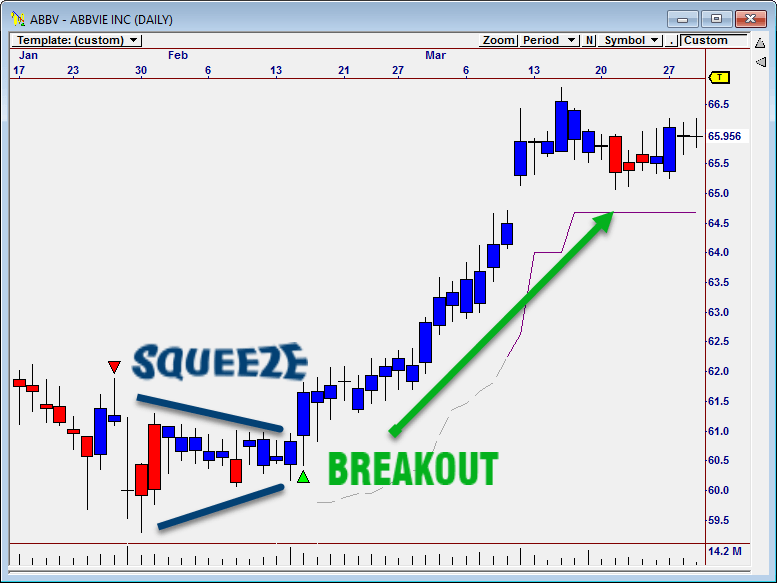

SqueezeTrader is looking for a pop in ALK.

The profit magic of SqueezeTrader is based on finding one of the most profitable setups in any market.

ALK made a splash in the news not long ago for buying Virgin America, but the stock recovered and has continued higher after pivoting on a higher low which confirmed precisely on the 50 SMA a few sessions ago. Since then, volume has remained steady and we have all of our indicators pointed in the bullish direction. ALK will test resistance at $92, but if that level is broken, we may see a run up into the $95 zone.

This signal was fired by our brand new strategy suite, SqueezeTrader. SqueezeTrader’s mission is to find the most profitable setups in any market. When the bulls and the bears fight over a security, the stock’s price goes into a “squeeze”. Pressure builds up in the process. Once one side wins, an explosive move often follows.

The Squeeze Trade has been used by many professional traders to capture big gains in both for both real-time and EOD. We have included the techniques professional traders like John Carter and John Bollinger use to find the best Squeeze Trades. If you’re interested, Jeff Drake, our tech chief who made the nuts and bolts of this strategy suite, recorded an awesome seminar that you can check out here!

The last signal of the day is featured on Valero.

Our good friend, the Darvas Box Strategy Suite, like VLO for a bullish push.

VLO pulled back today along with the rest of the energy sector after an anemic crude report this morning. But what’s interesting about VLO is where it ended up. It hit the breaks right at the 50 SMA, which is a hugely important moving average that millions of traders use to gauge a stocks overall mode. If a stock is above the 50 it’s considered in a bullish mode, and if its above the 200 SMA (which in this case it is) even better. It is also testing a Darvas Support level right at $64. One thing to keep in mind about support and resistance. While we give them exact numerical values, they can start to influence price movement slightly before or after they are tested. This could be a great reversion move and provide a bounce back into the $67 zone. Keep a sharp eye on this one.

As stated, this signal is provided by the Darvas Box plug-in. The strategy is based on Nicolas Darvas’ work, which has been used successfully for decades by vast amounts of traders. What the Darvas Box is looking for are increases and decreases in momentum. The Darvas strategies use market momentum to enter and exit trades. If a stock’s price breaks out of a Darvas Box or reverses off of a Darvas support level it is a considered a solid long candidate. As we see, VLO is doing the latter.

Have a wonderful night and we’ll catch you back here tomorrow evening.

The products and demonstrations listed on this website are not recommendations to buy or sell, but rather guidelines to interpreting their respective analysis methods. This information should only be used by investors who are aware of the risks inherent in trading. Nirvana Systems shall have no liability for any investment decisions based on the use of their software, any trading strategies or any information provided through other services such as seminars, webinars, or content included in the SignalWatch website.

About the Author Ryan Belknap

Ryan has been with Nirvana since 2012 and has been manning the trading desk since Day 1. He was one of the founding members of Nirvana's Trading Lab and also TraderSource.com along with Ryan Olson and Russell Casperson. Ryan logged more than 3,500 hours trading and educating live in the Lab. He is also the lead author of SignalWatch.com. Ryan is a seasoned educator and has conducted numerous educational webinars and is an OmniTrader University instructor. Ryan prefers swing trading and position trading. Outside of the market, Ryan has passions for the outdoors, baseball, exercise, coffee, pop-culture and spending time with his family.