- You are here:

- Home »

- Today's Trades »

- August 15th, 2017

August 15th, 2017

Signal of the Day

Good afternoon everyone! Wow, it feels like it has been sometime! But we are all back from various vacations and ready to hit the signal trail once again. Today the indexes closed mixed as the Nasdaq and S&P both slipped while the Dow 30 hung on to a tiny gain. As for today’s signal, we are going to be looking at one reversion to mean signal on Dollar General. It has been in a bullish mode and just underwent a significant pullback which triggered several short-term strategies to look for a bounce. Let’s have a look.

DG’s large pullback is responsible for the CRT-3 long signal, which is looking for a quick, bullish reversion move.

CRT-3

So this chart looks a little daunting after DG dropped almost 4% today. And that is noted. But what we are looking for in this particular instance is not a long term reversal, but rather a short reversion bounce off of support and its major moving averages close to $73-$73.50. It is oversold obviously, putting it in prime reversal territory. It is not uncommon to also see snapback trades after moves of such magnitude in the immediate following sessions. We’ll see if this holds true for DG. If we do see the bouce, we could be looking at push back into the $74-$75 zone before too long.

This signal was fired by the CRT-3 strategy which is part of the Connors RSI Module. The Connors RSI Module looks exclusively for reversion

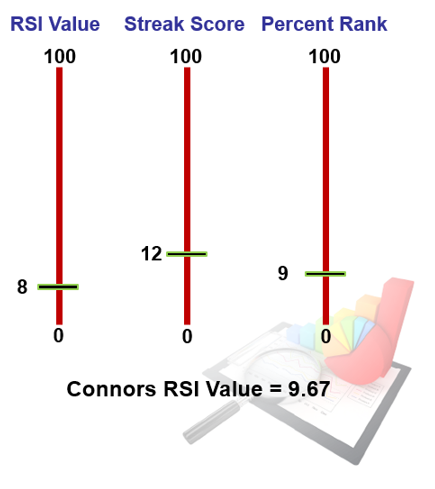

The RSI, the Streak and the Percent Rank make up the Connors RSI.

moves using a composite indicator made of three different filters to find the best candidates. It looks at your basic RSI indicator to determine if a stock is oversold or overbought, determines its streak and the percentage rank. Once all three indicators combine and provide an value in the oversold territory (0-30) a long reversion signal is fired. The advantage of the Connors RSI over other momentum indicators is that we are using an average of three measurements.

The CRT-3 strategy takes advantage of the Connors RSI and other momentum indicators because of the composite. We added Stochastics and the Williams % R systems to give us better signals.

The CRT-3 Strategy is awesome but the best part about it is that if you upgrade your OmniTrader, you score if for free! Not too shabby my friends. And while we’re on the subject if you have not signed up for your free OT, you need to do so now!

That’s all for tonight, we’ll catch you back here tomorrow.

![]()

The products and demonstrations listed on this website are not recommendations to buy or sell, but rather guidelines to interpreting their respective analysis methods. This information should only be used by investors who are aware of the risks inherent in trading. Nirvana Systems shall have no liability for any investment decisions based on the use of their software, any trading strategies or any information provided through other services such as seminars, webinars, or content included in the SignalWatch website.