- You are here:

- Home »

- Today's Trades »

- Signals of the Day – June 15th

Signals of the Day – June 15th

June 15th

Hello all! It was an interesting day as the market got off to a rough start this morning before rebounding and gaining back a good amount of those initial losses. The Dow closed down -.07%, the S&P -.22% and the Nasdaq with biggest slip at -.47%. Crude oil also tumbled below $45 per barrel and finished down over -1%. We’ll see how the week closes out tomorrow, but with a lack of fundamental data and solid Fed minutes, it looks like it should be a relatively quiet Friday.

Powered by OmniTrader

Did you know that you get a free OT 2017 trial just for being part of the SignalWatch community?

Now, on with the signals!

WaveTrader is looking for the next wave of buying on Hershey.

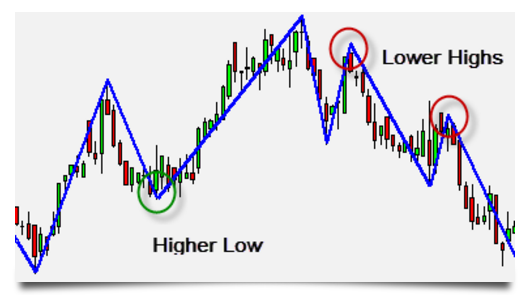

This is a very basic example of the pivots WT3 is searching for.

HSY enjoyed a fantastic month of May before starting its current pullback, but from the look of things, it appears as if the next wave of buying may just be washing ashore now… It is testing a higher low along support at $114 and is well above both the 200 and 50 SMAs, which confirms to us that HSY is in a predominantly bullish market mode. Volume is also on the rise, which could point to that next wave of buying that we’re on the lookout for.

As far as the strategy goes, WT3 Short Term is part of the WaveTrader 3.0. WT3 is designed for swing traders, seeing as it only seeks out stocks that currently have Higher Lows & Lower Highs. Why just those two things? Because in traditional Swing Trading, we buy on pull-backs at a Higher Lows and n correcting markets, we want to Short the first Lower High. WaveTrader is designed specifically to find these Higher Low and Lower High pivots before they finish forming. It’s really great stuff. If you’d like dive deeper on WaveTrader, feel free to do so here.

Next on the list, JPM.

Darvas Box is looking for renewed vigor in JPM.

Darvas Classic

This signal on JPM is provided by the Darvas Box plug-in. The method behind the strategy comes to us via the work of Nicolas Darvas, which has been used successfully by untold amounts of traders throughout the decades. Darvas is essentially looking for increases and decreases in momentum. Darvas uses market momentum to execute orders as well as exit a trade. If a stock’s price breaks out of a Darvas Box, like we see on JPM, it is a considered a solid long candidate. As we see, JPM fits the bill.

It has pulled back to test the 50 SMA, which is also acting as support, which is also the top of the last Darvas Box. All of these levels are forming up to make a solid confluence level and also a nice higher low pivot. If this call on JPM by Darvas does indeed carry through, we may see a quick move back into the $88-$90 zone.

For our last signal, lets take a look at PPL.

The Secret Sauce has found a great higher low opportunity on PPL.

PPL has been trending higher for quite some time and it is now pivoting back to the upside after forming a higher low pivot on top of support at $39, which is also very close to its 50 SMA. It is oversold on the RSI and Bollinger Band indicators, which puts it right in the sweet spot for new long entry opportunities. This trending move is about as smooth as it gets and if things continue to go as well as they have been, we could be looking at PPL reaching the $40 zone sooner than later.

The strategy that found this signal is called the SS Heiken Ashi 2, with the SS standing for Secret Sauce. This is the sequel if you will to SS 1, which arrived in 2014, exclusively for VisualTrader. The Secret Sauce is all about Relative Momentum. This plug-in identifies symbols that are outpacing the market, as well as those that are lagging behind. By measuring internal forces, we can discover which symbols are being accumulated, and which are being sold off. By knowing a stocks Relative Momentum, we can discern where and when stocks have become overbought and oversold, which leads to great entries and exits, thus, huge profit potential. To learn more check out the SS’s literature here.

If you are looking for more information on any of our strategies or strategy suites, they can be found over in our store over at NirvanaSystems.com, or just click here.

That’ll do it for us folks. Have a wonderful evening and take care!

The products and demonstrations listed on this website are not recommendations to buy or sell, but rather guidelines to interpreting their respective analysis methods. This information should only be used by investors who are aware of the risks inherent in trading. Nirvana Systems shall have no liability for any investment decisions based on the use of their software, any trading strategies or any information provided through other services such as seminars, webinars, or content included in the SignalWatch website.

About the Author Ryan Belknap

Ryan has been with Nirvana since 2012 and has been manning the trading desk since Day 1. He was one of the founding members of Nirvana's Trading Lab and also TraderSource.com along with Ryan Olson and Russell Casperson. Ryan logged more than 3,500 hours trading and educating live in the Lab. He is also the lead author of SignalWatch.com. Ryan is a seasoned educator and has conducted numerous educational webinars and is an OmniTrader University instructor. Ryan prefers swing trading and position trading. Outside of the market, Ryan has passions for the outdoors, baseball, exercise, coffee, pop-culture and spending time with his family.